S&P downgrades two Dubai property giants to junk status

Emaar Properties and DIFC Investments are cut to BB+ by ratings agency on expectations the economy will shrink in 2020

London — S&P Global Ratings has warned that Dubai’s economy is set to shrink 11% this year, as it cut the credit ratings of two of the emirate’s biggest property firms to junk status.

Dubai, the Middle East’s trade and tourism hub, has been hit hard by coronavirus-containment measures and is set for an economic contraction almost four times worse than during the global financial crisis in 2009, S&P said.

“We now expect Dubai’s real GDP will shrink by about 11% in 2020, compounding the economic slowdown that began in 2015,” S&P analysts wrote in a note dated July 9, adding that the emirate’s fiscal deficit was expected to balloon to about 4% of GDP this year.

A growth rebound of about 5% is expected next year, but real GDP growth will then slow to 2% through to 2023, which would be half of what it has averaged for the past 10 years.

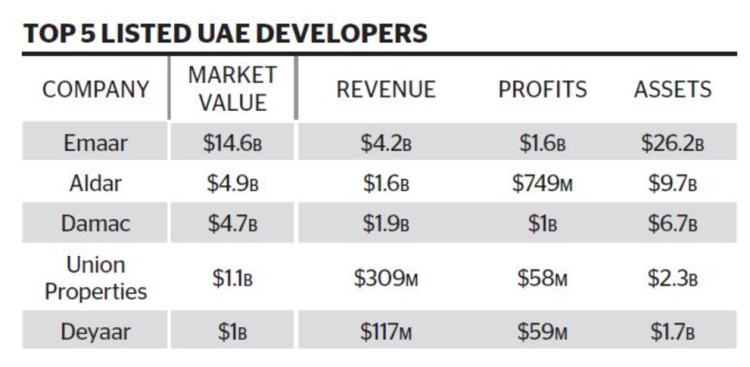

S&P downgraded Emaar Properties, the United Arab Emirate’s largest property firm and the builder of the world’s tallest building, Dubai’s Burj Khalifa, to a BB+ junk rating from an investment grade BBB- score.

It said it expected a 30%-40% slump in Emaar’s earnings in 2020, a 15%-20% dive in overall revenues, while the expected recovery in 2021 would be only partial.

DIFC Investments, a unit of the company running Dubai’s International Financial Center free zone, was cut to BB+ from BBB- as well.

“We expect Dubai’s balance sheet to deteriorate, reducing its ability to provide extraordinary financial support to its related entities,” S&P’s analysts said.