Morgan Stanley Sees Dubai Property Rally Lasting for Years

The rally in Dubai’s residential property prices isn’t stopping anytime soon, according to Morgan Stanley.

“Robust demand, peaking supply growth and long lead times for new projects could lead to a tighter-than-expected market over the next several years,” analysts Katherine Carpenter and Nida Iqbal wrote in a report.

For properties worth at least 10 million dirhams ($2.7 million), a record 84 changed hands in March, according to data from real estate consultant Property Monitor.

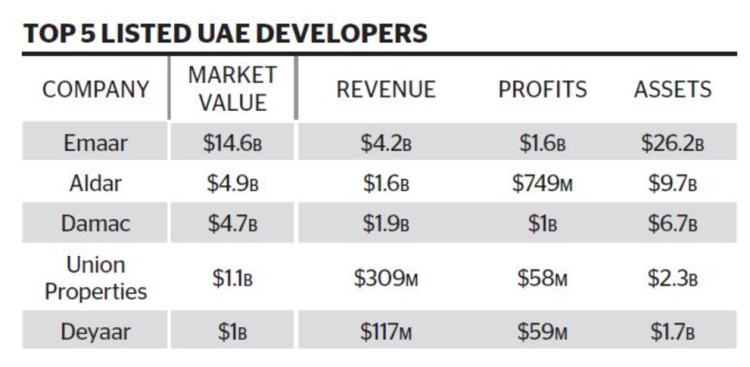

Buying real estate is one of the fastest ways of getting a residency permit in Dubai, which further eased coronavirus-linked restrictions on Monday. Emaar Properties PJSC, the biggest listed developer in the emirate, posted a 65% jump in villas sales in the first quarter from the year-ago period.

Demand picked up amid “a wave of government reforms over the past 12 months, attractive mortgage rates, and a shift in demand patterns due to Covid-19,” according to Morgan Stanley.

A gauge tracking real estate shares in Dubai has gained about 8% this year, though it’s still down 74% from a peak in 2014. Emaar Development, a unit of Emaar Properties, surged as much as 9.5% on Tuesday.