Supply, price movements influence buyer choices

The entry of new supply in the remainder of the year is expected to ensure that the market will continue to favour homebuyers at least in the medium term. According to Chestertons’ Dubai Residential Market Overview: Q2 2018, new supply will continue to outstrip demand in the next few months, even as quarter-on-quarter sales prices dropped 1 per cent for apartments and remained flat for villas.

Against this backdrop, Property Monitor has also reported a spike in the purchase of secondary villas and town houses, overtaking off-plan purchases for the first time since October last year. Off-plan apartments, meanwhile, continued to lead secondary sales since February 2016.“Irrespective of the unit size, there has been an 8 per cent increase in apartment sales in the last 12 months compared to the previous year,” says Moe Abeidat, chief technology officer of Property Monitor. “Although studio and one-bedders still dominate the market, studio and one-bedder sales have declined in the last 12 months and two- and three-bedroom apartment sales have increased by an average 66 per cent.”

The increase in sales of bigger apartments with more than two bedrooms may reflect a rising number of homebuyers versus investors due to affordability and supply options, according to Abeidat. Homebuyers looking for affordable options also generally favour bigger apartments over villas and town houses, which have a bigger ticket price and higher maintenance costs. As a result, overall villa and town house sales compressed by 18 per cent.

Property differentiation

Abeidat says the increase in supply has triggered a re-evaluation among many residents whether to renew their rental contracts or purchase their first home in Dubai. Many prospective buyers consider the condition and age of a property, although equally important for them is access to amenities and schools, says Abeidat.

He notes there are now more mature buyers looking to capitalise on the current market landscape by building equity through home ownership. “Secondary market prices reacted to the large supply in off-plan by providing more affordable housing options available more immediately than their counterparts in off-plan,” explains Abeidat. “Buyers want to move quickly on a well-priced opportunity, reduce wasted expense towards rent and choose established communities with high-quality build and maintenance.

“Price movement in the last 12 months has varied not only between communities, but also among different buildings within the same community, thus reflecting greater differentiation in how available properties are now trading. For instance, if we look at some buildings within Dubai Marina, the 12-month change in prices ranges from less than 1 per cent to nearly 4 per cent, and hence specific building characteristics must be considered when evaluating a purchase.”

As today’s buyers have more choices than at any other time, the condition of secondary market properties within established communities is considered a significant influencer for any purchase decision, says Paul Christodoulou, managing director of Gulf Sotheby’s International Realty.

“For example, Emirates Living is a very popular community among both GCC and expat buyers, but sometimes the condition of 12-year-old properties can certainly increase or decrease the price, and also the desirability of the said property,” says Christodoulou. “Town houses have proved popular for those clients who want the flexibility of a villa, but without the running costs.”

The influx of first-time buyers is the most significant change seen in the market, he adds. “These buyers are not necessarily all new people coming into the market, but more like long-term expats who have finally decided that now is the right time to buy.”

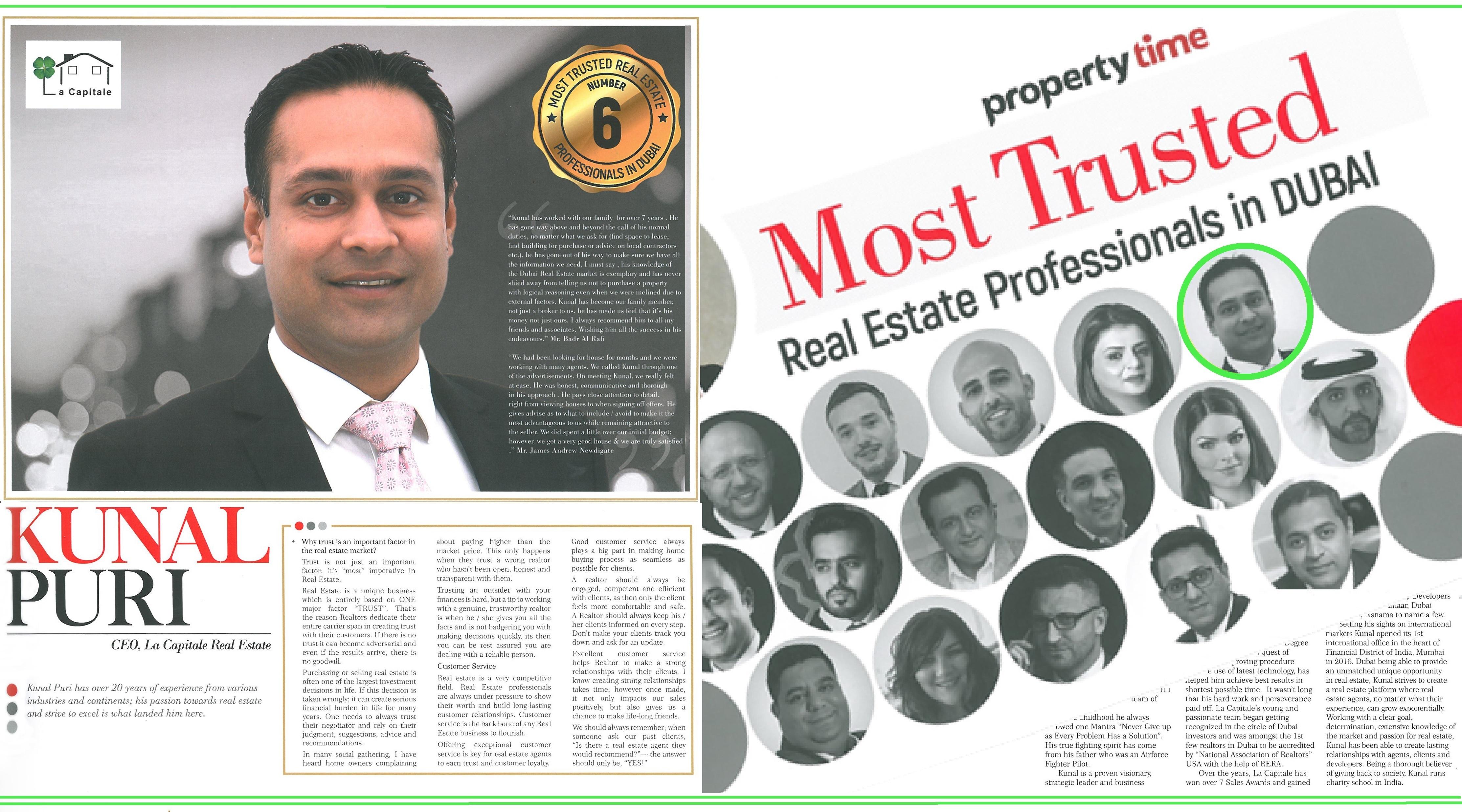

Value offeringsAlthough apartments remain popular and more affordable, Kunal Puri, group CEO and managing director of La Capitale Real Estate, says current pricing trends have also made town houses and villas value-for-money choices, especially for families.

“Currently, the major demand in the market is from end users, who are mostly families,” says Puri. “Studies show that only 50 per cent of apartment users are families, whereas 80 per cent of town house and villa users are families.”

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)